The Status of the US-China Trade Conflict: September 9, 2019

(Photo by Tobias A. Müller on Unsplash)

By Rob La Terza

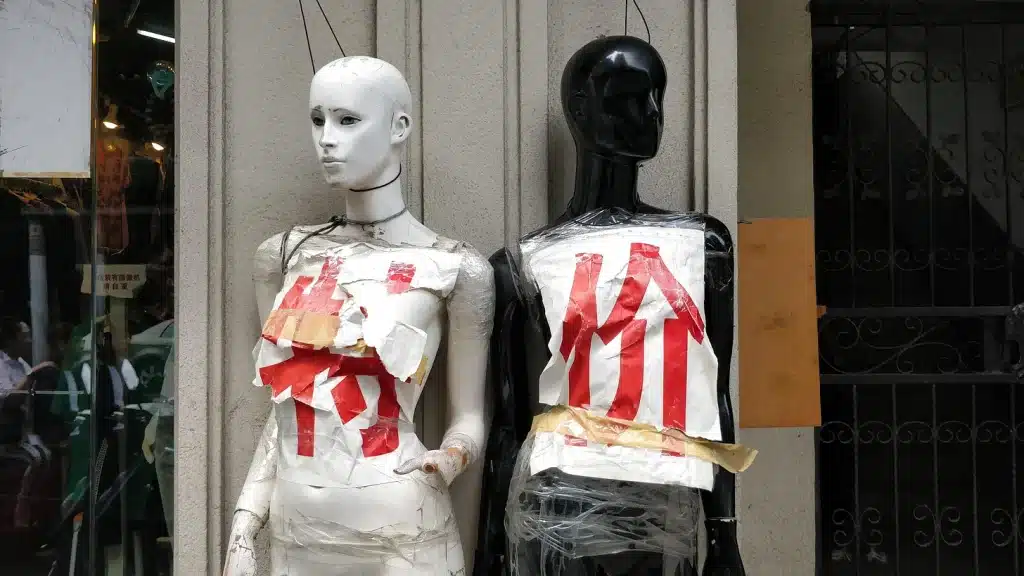

The US-China trade conflict continues with a set of new tariffs imposed on September 4th [1]. This escalation hit the American consumer harder than ever, with a 15% tariff being levied on 3,800 different items from China. The tariff was enacted on a portion of $300 billion worth of shipments on September 1st, 2019. Tariffs on the remainder of the $300 billion will go into effect on December 15th. This tariff is likely to affect American consumers more than previous tariffs because 60 percent of the products included in this round of tariffs are finished consumer products. The category of finished consumer products is a broad one, encompassing clothing, electronics, appliances, food products, and textbooks. To keep prices down, some manufacturers are responding by using lower quality materials in their products or by using less packaging. However, these responses are unlikely to completely protect consumers, who should expect to experience a moderate price hike in the coming months. While large chain retailers will likely be able to weather the short-term effects of this round of tariffs, small businesses will likely suffer as they are forced to raise prices and consequently see decreasing sales. If tariffs are not lifted, large retailers will also be forced to pass price increases on to consumers. Those price increases will continue to grow if tariffs are increased in the future. In addition to the new 15% tariff, President Trump will raise existing tariffs on a set of $250 billion worth of products such as industrial goods, luggage, hats, and furniture from 25% as of May 2019 to 30% on October 1st.

Even as President Trump ramps up the trade war, the Chinese economy appears strong [2]. In August, China’s manufacturing activity rose to its highest point in five months thanks to stimulus measures enacted by Chinese leadership. The Caixin China General Manufacturing PMI also rose to 50.4 points, exceeding a Reuters forecast based on polling economists. Despite these positive signs, China faces some concerns. Analysts expect that China will have to increase its monetary easing to allow more credit to flow into its economy, aiding companies that are currently unable to secure loans. Dr. Zhengsheng Zhong, director of macroeconomic analysis at the CEBM group said, “China’s economy showed signs of a short-term recovery but downward pressure remains a long-term problem. Amid unstable Sino-American relations, China needs to step up countercyclical policies.” Economists such as Julian Evans-Pritchard of Capital Economics warned that China’s leaders must enact substantial policy responses to continue growth. Evans-Pritchard said, “Clouds are still hanging over the outlook- global demand looks set to weaken further and a long-overdue pullback in property construction is getting under way.”

Clouds hang over the US’s economic outlook too, as chief US economist at UBS Seth Carpenter warned that the trade war is pushing the US closer to a recession [3]. Carpenter writes that economic challenges continue to grow as the number and magnitude of tariffs grows. He also points out that Trump’s salvo of tariffs from September 1 indicates that, “25% is not a ceiling on tariffs and thus must increase materially the uncertainty about the outlook for the trade war for businesses.” As tariffs continue to impact consumer goods, they will continue to disrupt production lines and potentially increase unemployment, thus lowering business investment and household spending. Carpenter also says that tariffs will negatively impact consumption of goods and services, which he says account for 70% of the US economy. Tariffs work by leading consumers to spend less due to higher prices. Less consumer spending leads businesses to spend and hire less, driving up unemployment. Carpenter predicts that the US economic growth will slow down and that unemployment will rise in the first six months of 2020. Despite those warnings, Carpenter believes that the US will narrowly avoid a recession assuming there are no further shocks to the economy.

These concerning developments in the US’ economy come at a critical time for President Trump, who has tied his political fortunes to the US economy during his first three years. If the economy slows down in accordance with Carpenter’s predictions, the embattled president’s bid for reelection may be in greater danger. Carpenter’s warnings are not the only negative forecasts on the horizon, as the US recently experienced a yield curve inversion [4]. In short, a yield curve inversion is when investors receive a lower percentage return on their investment for longer-term bonds than for shorter-term bonds. Longer-term bonds typically yield a greater return on investment. Yield curve inversions are often seen as a reflection of dwindling market confidence in the economy and are regarded as predictors of recession. The last seven US recessions were preceded by inversions of the three-month bill and ten-year Treasury yields. The three-month bill and ten-year Treasury yields inverted to their deepest point since the 2008 financial crisis in May [5].

Although the conflict appears to be escalating, there is reason for hope [6]. New trade negotiations have been scheduled for early October, and Chinese insiders appear to believe that these talks may be more fruitful than previous negotiations. Hu Xijin, editor of the prominent tabloid The Global Times, has said, “Personally I think the US, worn out by the trade war, may no longer hope for crushing China’s will. There’s more possibility of a breakthrough between the two sides.” Hu’s record on predicting events in the trade conflict has been impressive. Most recently, Hu accurately predicted that China would impose retaliatory tariffs in response to President Trump’s new tariffs within hours of the official Chinese announcement. Additionally, on September 4th the respected WeChat blog Taoran Notes predicted that the October talks will likely lead to change in the conflict. Taoran is run by the state-owned newspaper Economic Daily and has been cited by US media. However, Taoran cautioned that the talks could still result in a worsening rather than an improvement in the conflict.

At this point, anything is possible in the future of the trade conflict. Both sides have significant incentives to reduce tensions. China’s economy has shown resilience, but it will feel more pain if the trade conflict continues or if tariffs are increased. The Chinese government has already been forced to use “monetary and fiscal” policy action to protect its economy and will be forced to do so repeatedly if the situation does not improve. Bruce Kasman, chief economist for JP Morgan, says that the September round of US tariffs may push China’s economy further than Beijing has the capacity to counteract [7]. Kasman also notes the devastation the trade war has wrought on the global economy, predicting that there is a 40% chance of global recession in the coming six to nine months. For its part, the US economy has shown signs of strain as the trade conflict presses on. President Trump may feel political pressure to end the conflict, as the outcome of his reelection bid may hinge on the performance of the US economy in the months between now and election day. China has shown an impressive ability to target Trump’s core supporters with its tariffs, and US tariffs on finished consumer goods are likely to alienate American voters who are forced to buy at higher prices. Knowing Trump’s precarious political situation, China may take its cues from him. Because of the two countries’ different political systems, President Xi is under far less personal strain than Trump is. China may believe that the trade war could prevent Trump from being reelected and that China could secure more favorable terms from Trump’s successor. If that were the case, China would have an incentive not to make a deal if it is unsatisfied with the terms the US presents in October. However, President Trump has publicly stated that he will double down if China attempts to stall until after the 2020 presidential elections, making stalling a risky gambit.

The ideal outcome for the future of the US-China relationship and for the health of the global economy would be an imminent end to the trade conflict. The US’ grievances with China’s trade practices could be addressed more effectively and with far less collateral damage through multilateral negotiations including other world economic powers. If it ends now, the trade war’s damage to the world economy can be contained. However, the risk of a global recession grows with each month the trade conflict continues. The harm that the trade conflict inflicts upon the US-China relationship will also grow more difficult to reverse as the conflict continues. Niall Ferguson, a senior fellow at Stanford University’s Hoover Institution, has stated that the trade war has brought the US and China into the early stages of a second Cold War [8]. Ferguson argues that the conflict has spread from an economic conflict to one involving “technological and geopolitical issues.” This spread, Ferguson argues, means that tensions will continue between the US and China even if the trade conflict ends. The ongoing trade conflict decreases the likelihood of the US and China successfully addressing their technological and geopolitical disputes, further souring bilateral relations. A quick conclusion of the trade conflict is essential to allow a positive US-China relationship and to restore the stability of the global economy.

Rob La Terza is an intern in The Carter Center’s China Program. This article is an update of developments in the US-China trade conflict. The views expressed are those of the author and do not represent those of The Carter Center.

References:

[1] Davidson, Paul. “Trade War: How Tariffs on Clothing, TVs and School Supplies Could Affect You Next Week.” USA Today. Gannett Satellite Information Network, August 30, 2019. https://www.usatoday.com/story/money/2019/08/30/china-tariffs-new-duties-target-clothing-tvs-other-consumer-goodsr/2134546001/

[2] Weinland, Don. “China’s Economy Shows Signs of Resilience Despite Trade War.” Financial Times. Financial Times, September 2, 2019. https://www.ft.com/content/e0414be8-cd28-11e9-99a4-b5ded7a7fe3f

[3] Reincke, Carmen. “The Ever-Escalating Trade War with China Has Brought the US to the Brink of Recession, a Top Economist Warns.” Business Insider. Business Insider, September 4, 2019. https://markets.businessinsider.com/news/stocks/next-recession-us-china-trade-war-has-america-at-brink-2019-9-1028495118

[4] Chappata, Brian. “The Yield Curve Is Inverted! Remind Me Why I Care.” Bloomberg.com. Bloomberg, March 22, 2019. https://www.bloomberg.com/news/articles/2019-03-22/the-yield-curve-is-inverted-remind-me-why-i-care-quicktake

[5] Franck, Thomas. “Bond Flash Economic Warning as 3-Month Yield Tops 10-Year Rate by Most Since Financial Crisis.” CNBC. CNBC, May 29, 2019. https://www.cnbc.com/2019/05/29/us-bonds-wall-street-monitors-fresh-batch-of-economic-data-auctions.html

[6] Li, Yun. “Reliable China Insiders Hint That This Round of Trade Talks Could Lead to a ‘Breakthrough’.” CNBC. CNBC, September 5, 2019. https://www.cnbc.com/amp/2019/09/05/china-insiders-hint-this-round-of-trade-talks-could-lead-to-a-breakthrough.html

[7] Lee, Yen Nee. “JP Morgan Says New US Tariffs Will Test China’s Ability to Prop Up its Economy.” CNBC. CNBC, August 16, 2019. https://www.cnbc.com/2019/08/16/jp-morgan-on-us-china-trade-war-risk-of-global-economic-recession.html

[8] Meredith, Sam. “US-China Trade Dispute Is ‘Already in the Early Stages’ of a Second Cold War, Niall Ferguson Says.” CNBC. CNBC, September 6, 2019. https://www.cnbc.com/2019/09/06/us-china-trade-war-in-the-early-stages-of-second-cold-war-niall-ferguson-says.html