Much Ado About Steel Dumping

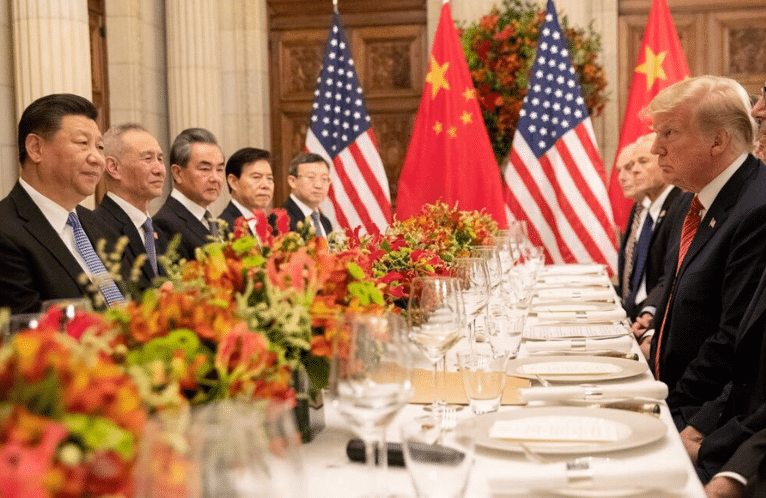

There’s no doubt that US-China trade is becoming a hot-button issue in this election cycle. Everyone from New York businessman Donald Trump to Vermont Senator Bernie Sanders are arguing that US free trade policies have contributed to the detriment of the American economy and hurt the American worker. As recently as three months ago, the United States Department of Commerce announced it would be placing duties of up to 265.79% on Chinese steelmakers to combat alleged “dumping” of Chinese steel in the US market.

“Dumping” is the practice of selling goods below cost in order to “improperly gain market share.” It is also a practice of which the China has vehemently denied. The issue of Chinese steel dumping has caused an assortment of concerns and has even called into question whether China should be granted market economy status in the World Trade Organization.

Politicians in Europe and the United States have taken steps against the Chinese, seeking higher tariffs and duties on China to punish the country for bad behavior. Unfortunately for China, it would seem that much of the trouble has arisen from poor central planning, which devoted too many resources to steel production. This has thus concluded in an overcapacity of steel, which has rendered the entire industry unprofitable.

The Cato Institute’s Dan Pearson called for China to shut down some of its steel mill, not in order to bow to Western pressure, but “because reducing capacity would strengthen the remaining portion of China’s own steel industry.” From Pearson’s view, the appearance of dumping is not an intentional jab at international steel markets, but rather the logical consequence of China’s overcapacity.

Whatever the intentions, however, China’s overcapacity does give it an opportunity to increase its market share in steel markets, which have been met with fierce criticism from business leaders and labor groups in the United States and Europe.

“China’s government overtly manipulates its currency and subsidizes its steel industry in ways that violate international trade laws — doing everything to push the steel to market — even if that means dumping the products in the United States at less than fair market value” write Christopher Masciantonio, government affairs for US Steel and Robert McAuliffe, Pennsylvania Director of United Steelworkers. Seeing as American free trade policies seem to be at the benefit of China, leaders like Masciantonio and McAuliffe have called for the state and national leaders to protect domestic producers and to uphold the trade laws that are meant to prevent China from, in the words of Donald Trump, “raping ” the United States on trade.

Unfortunately, America’s solution to combating China’s overcapacity of steel falls into old protectionist rhetoric, which, rather than protecting American steel producers, on the contrary may hurt the US economy in general. According to Pearson, the “real cost of import restrictions is the harm they do to manufacturers of value-added products that use steel as an input” a sector which is “a much larger factor in the U.S. economy than are steel producers.” By increasing tariffs in order to try and protect uncompetitive American steel, the United States would effectively be throwing out the baby with the bathwater.

In the long run (and in the big picture) higher tariffs on Chinese goods, while preserving jobs in a few sectors, would be disastrous for the US economy. Let’s take steel (or raw materials for that matter) as an example. Imagine that by creating higher tariffs, Chinese steel is marked up, making American produced steel cheaper. US produced steel, however, is not much cheaper than the price of Chinese steel, and the cost of production for, let’s say, car manufacturers rises. This would also mean higher prices for cars, extra costs which would fall down to the consumer.

Now, suppose that the manufacturer is large enough to see that it is losing money on this deal. What will it decide to do? Most logically, it would leave the United States for some other country, let’s say Mexico. In Mexico, they will be able to buy the cheaper Chinese steel (which would not be subject to US duties) and be able to produce the car for much cheaper than the manufacturers who decide to remain in the United States, given that the logistics allow it to be profitable.

Finally, and here’s the kicker, imagine that the manufacturer who moved to Mexico decides to sell the car to the American market. Compared to the US-based manufacturers, the Mexico-based manufacturer can afford to sell their product at lower prices and earning a higher profit. Where does this leave the United States? It would lead to more expensive cars, a loss of US jobs from the manufacturer who decided to move to Mexico, and the outcompeting of US-based manufacturers to a Mexico-based manufacturer.

In reality, everything from quality to consumer preference will play a role in the success of products in the US market. Regardless, boosting up tariffs for the sake of protecting US steel jobs will be to the detriment of the US economy as a whole, hurting industries that require steel as an input factor. A 2003 article published on the Wharton school website even went so far as to argue that steel tariffs “protect a few at the expense of the majority.”

The answer much ado about steel dumping isn’t an easy one. While China’s overcapacity has been to the detriment of China’s economy, the cheaply priced steel has hurt American steel producers as well. Pearson suggests that the United States should thank the Chinese for the overcapacity of steel, which has led to competitive American products that use the commodity as an input. Such a move would be a wake-up call to China’s central economic planning apparatus who would, in Pearson’s view, respond by closing some steel mills.

As the world globalizes, trade is, whether we like it or not, an international enterprise. Each day, the situation is changing, and each day, David Ricardo’s principle of comparative advantage becomes shifts among countries. While the US may not be advantageous in certain sectors anymore, new opportunities open up every day thanks to technological innovation. With economic growth, there will naturally be growing pains. Protectionism, however, will serve only as a short term painkiller, the only solution is for the United States to get competitive, find its advantages, and adjust. We cannot put too much attention to bringing back lost jobs, for as Fletcher School professor Daniel Drezner reminds us, some of the jobs we are trying to get back just don’t exist anymore.

By Aaron Walayat