In Bold Move, U.S. Steel Launches Campaign To Stop China Imports

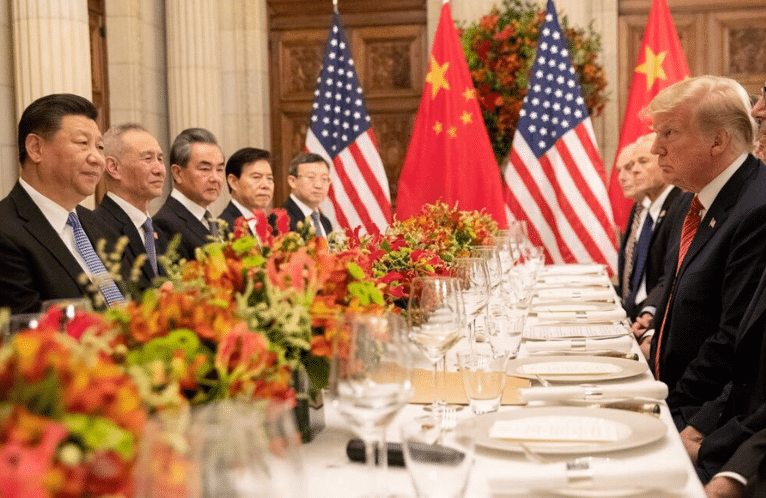

U.S. Steel Corp (X.N) has launched a campaign to prevent imports from China’s largest steel producers, it said on Tuesday, the boldest step yet by a U.S. company as a trade brawl with the world’s largest steel producer escalates.

In a complaint to the U.S. International Trade Commission (ITC), the U.S. steelmaker called on regulators to investigate dozens of Chinese producers and their distributors for allegedly conspiring to fix prices, stealing trade secrets and circumventing trade duties by false labeling.

Analysts said it could be the most significant development in U.S. steel trade in a quarter of a century, and will likely ratchet up tension between China and major steel producing nations, as the global industry grapples with chronic oversupply and sluggish demand.

The petition, known as Section 337 and used to protect against intellectual property theft, listed some of China’s top producers, including Hebei Iron & Steel Group (000709.SZ) and Anshan Iron and Steel Group and Shandong Iron & Steel Group Co [SDONGG.UL].

“We have said that we will use every tool available to fight for fair trade,” said U.S. Steel Corp President and Chief Executive Officer Mario Longhi in a statement.

“With today’s filing, we continue the work we have pursued through countervailing and antidumping cases and pushing for increased enforcement of existing laws.”

It comes after U.S. officials last week warned that China should take steps to cut excess output or face possible trade action and Australia said it will impose import duties on certain types of Chinese steel to protect domestic steelmakers.

China’s Commerce Ministry called steel a “mature product” where “intellectual property rights disputes do not exist”, and said industry from both the United States and China should work together to address overcapacity caused by weak global demand.

“So-called accusations of intellectual property rights violations have no factual basis. We hope the U.S. International Trade Commission will reject these accusations,” the ministry said on Wednesday in a statement on its website.

Even before the ITC makes its ruling, Chinese exporters may curb shipments fearing retroactive measures, said Michelle Applebaum, analyst at Steel Market Intelligence.

The ITC has 30 days to decide whether to initiate the case. It is also investigating allegations of unfair trade practices in the stricken aluminum industry.

Beijing has defended itself against the allegations, saying it has done enough to reduce steel capacity and blaming global excess and weak demand for the industry’s woes.

GOING IT ALONE

The Pittsburgh, Pennsylvania-headquartered company has filed the complaint on its own and is relying on a clause in U.S. tariff law 337 not used by the steel industry for almost four decades.

“It’s a bold step,” by U.S. Steel, said Patrick Macrory, director of the International Trade Center at the International Law Institute in Washington.

In 1978, eight U.S. firms that used the clause went after 35 Japanese competitors over welded stainless steel pipe imports. Back then, rather than barring the product from U.S. shores, ITC issued a “cease and desist” order against 11 companies for engaging in unfair competitive practices.

An official with a large Chinese state-owned steel mill, who asked not to be named, told Reuters that foreign steel producers should adapt rather than try to force China to change.

“The whole world is asking China to cut overcapacity and China is doing it. But steel mills in those regions are not competitive themselves and keep pointing their fingers at China,” the official said.

(Reporting by Josephine Mason in New York, David Lawder in Washington D.C. and Nick Carey in Chicago; Additional reporting by Michael Martina in Beijing and Ruby Lian in Shanghai; editing by Bernard Orr and Himani Sarkar)

By JOSEPHINE MASON, DAVID LAWDER, AND NICK CAREY Apr. 27, 2016 on Reuters

Read more here