Donald Trump’s Trade War Could Kill Millions Of U.S. Jobs

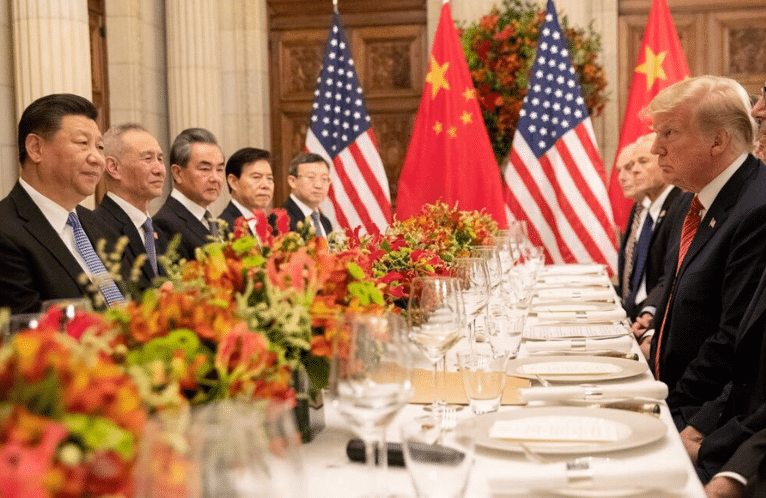

Trade has been one of Donald Trump’s great selling points on the campaign trail. China and Mexico are killing us, he has told crowds on his way to the lead position for the Republican presidential nomination, and if Trump wins the White House, he will fight back. The implication is that getting tough with our trading partners — by taxing their exports as they cross America’s borders — will bring jobs and prosperity to the United States.

An economic model of Trump’s proposals, prepared by Moody’s Analytics at the request of The Washington Post, suggests Trump is half-right about his plans. They would, in fact, sock it to China and Mexico. Both would fall into recession, the model suggests, if Trump levied his proposed tariffs and those countries retaliated with tariffs of their own.

Unfortunately, the United States would fall into recession, too. Up to 4 million American workers would lose their jobs. Another 3 million jobs would not be created that otherwise would have been, had the country not fallen into a trade-induced downturn.

The job losses would be halved if China and Mexico chose not to retaliate to the tariffs of 45 percent and 35 percent, respectively. In which case U.S. growth would flatline, but the country would not fall into recession.

The amount of predicted economic damage surprised Mark Zandi, chief economist for Moody’s Analytics, who prepared the model. He said it is magnified by the precarious — and historically unusual — state of the U.S. and global economies right now: Under the Moody’s model, the Federal Reserve has little power to slow the recession, because interest rates remain near zero. Congress refuses to enact any stimulus measures, such as spending increases or tax cuts, that might increase the federal budget deficit further.

What results, in the model, is a downward spiral of reduced economic activity. Prices rise on imported goods from China and Mexico, which has the effect of reducing spending power for American consumers. If China and Mexico retaliate, U.S. exports fall, forcing layoffs at American companies that sell to those foreign customers. The ensuing growth slowdowns spread to other trading partners, particularly in Europe, and cause stock markets to plunge, which in turn slows growth even more.

Within a year, the model predicts, the U.S. economy is in recession. “This is a pretty ugly scenario,” Zandi said, “one that I think any rational person would want to avoid.”

J.W. Mason, an economist at the liberal Roosevelt Institute think tank, questioned the model’s forecasts and its underlying assumptions. He predicted tariffs would likely have a much smaller effect on growth and employment in the United States.

A “more realistic” model, Mason said, “might get you higher or lower employment relative to the baseline, but either way the effects would be an order of magnitude smaller than this.”

Mason is critical, in particular, of the model’s assumption that the tariffs would lead to little return to the United States of the roughly 1 million factory jobs that economists say have been lost to China over the past decade and a half. Zandi said that assumption rests on companies being uncertain about how long the tariffs might remain in place, which would likely make them reluctant to invest in an American alternative to Chinese manufacturing.

The Moody’s model appears to be one of the first attempts to forecast the potential effects of levying a 45 percent tariff on Chinese imports and a 35 percent tariff on Mexican imports, as Trump has suggested.

The Wall Street Journal’s Bob Davis published an analysis on Thursday from Peter Petri, a Brandeis University economist and trade expert, which forecasts the tariffs’ effects on trade flows between the United States and China/Mexico but did not model the broader economic effects of those tariffs. Petri’s estimates of trade-flow effects are roughly similar to Zandi’s, though some of their assumptions appear to differ slightly.

The Moody’s analysis projects the U.S. economy would be 4.6 percent smaller by the end of 2019 if America levies tariffs on China and Mexico and those countries respond, compared to where it would be with no tariffs. It forecasts U.S. employment would be 7 million jobs lower than it would have been, and that the unemployment rate would hit 9.5 percent in the middle of 2019. The federal budget deficit would grow to be 60 percent larger than it would have been.

If China and Mexico do not retaliate, the model predicts, U.S. growth would slow to near zero in 2018. The economy would end up with 3.3 million fewer jobs than it would otherwise have in a no-tariff scenario.

Mason, a fellow at Roosevelt who is also an assistant professor of economics at John Jay College-CUNY, expressed skepticism not only of the predicted employment and growth effects, but also at the idea that China and Mexico would retaliate, if such retaliation would only hurt their economies more.

Gary Clyde Hufbauer, a senior fellow at Peterson, said it’s difficult to predict what effects such a tariffs might bring, because the United States has not attempted to impose anything comparable in recent history. But he said he believes the Moody’s forecasts are in “the realm of plausibility. My own view is that the shock would be a tsunami in the world economy.”

A Trump spokeswoman did not respond to a request for comment Friday morning.

Zandi said that the forecasts undercut Trump’s contention that trade is an area where some countries “win” at the expense of others. From a broad economic perspective, he said, shutting down trade is “a lose-lose” for the United States and its trading partners — and one that could have consequences in other areas of concern for Trump and his supporters: If tariffs cause Mexico to fall into recession, Zandi said, “you’ll have a lot more people knocking on the door” to immigrate to America.

By JIM TANKERSLEY Mar. 25, 2016 on the Washington Post

Read more here