China-Bashing? No, Not Again

It is US election season again, so it must be time to attack China on everything to do with economic and trade matters.

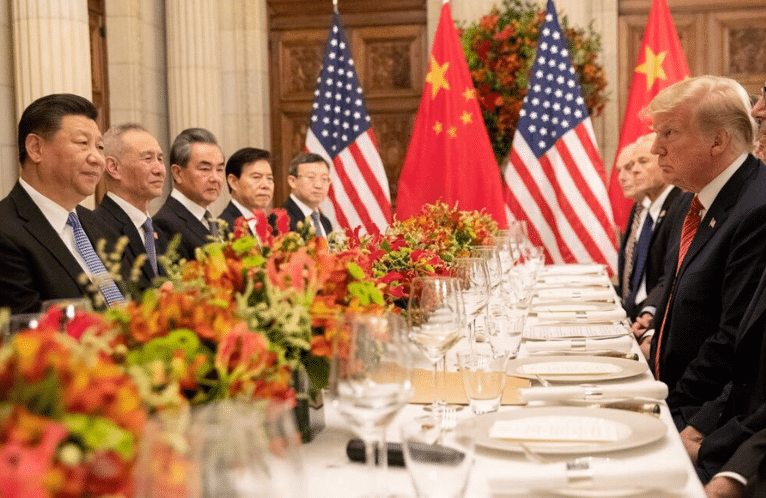

China may have made a couple of mistakes recently, but some of the claims being made by US presidential candidates, Republicans in particular, during their debates are so preposterous that they need to be corrected. For example, more than one candidate has claimed China has kept its currency artificially low to gain advantage in international trade. Republican front-runner Donald Trump has even pledged to impose tariffs on Chinese products to “level the playing field” even though that would be contrary to World Trade Organization rules.

The yuan has indeed slipped by about 6 percent against the US dollar in recent months – but only after rising more than 20 percent in recent years, which still means an overall gain of almost 13 percent. A true reading of the position is that the yuan has been pulled up by the strong dollar, and most economists would say it is now overvalued compared with most other currencies.

Some observers have blamed China’s reduced commodity buying for the fall in world prices, most spectacularly that of oil from more than $100 a barrel to $30. Yet China’s imports in 2015 were equivalent to 6.7 million barrels a day – a record high. The real reason for the sharp decline in oil prices is the substantial increase in supply.

And as China rebalances the economy to put more emphasis on the services sector, and less on domestic infrastructure spending, it needs less steel (and hence iron ore) and concrete. But as the Belt and Road Initiative starts to take off, some of the slack will no doubt be taken up by projects in countries along the routes.

Now to the errors and how to correct them. Probably the biggest mistake of the last decade was the effort starting in the autumn of 2014 to talk up the stock market.

By the middle of 2015, the Shanghai index had doubled, a rise that was totally divorced from economic fundamentals. Although the mainland stock market has a much smaller impact on the overall economy than in more advanced countries, when the inevitable crash came the PR effect was devastating. China is in the East, and media reports of the day’s trading begin with Tokyo, Sydney and Shanghai. The repeated sharp drops in stock prices and the clumsy attempts to prop up the market therefore attract worldwide attention every day.

China needs to follow more closely President Xi Jinping’s directive and let the market take a decisive role. That means accepting modest price/earnings ratios which create a healthy market. There is nothing to be gained by delay, so authorities should withdraw the special support measures and take the hit. Thereafter they should let the market find its true level and become a serious arena for solid companies to raise capital.

The next question concerns the exchange rate. By the middle of last year, the authorities had (correctly) concluded that the yuan was overvalued. They then devalued it for which the rest of the world was psychologically unprepared. The urgent need, therefore, is for more transparency. China should seek IMF assistance in assessing a reasonable value for the yuan, then move toward that figure using a “crawling peg” methodology. From that point on, the market should be allowed to determine a fair price.

China has joined the majors in the world economy club. It’s time it played by the big boys’ rules, too.

By MIKE ROWSE Feb. 6, 2016 on China Daily.