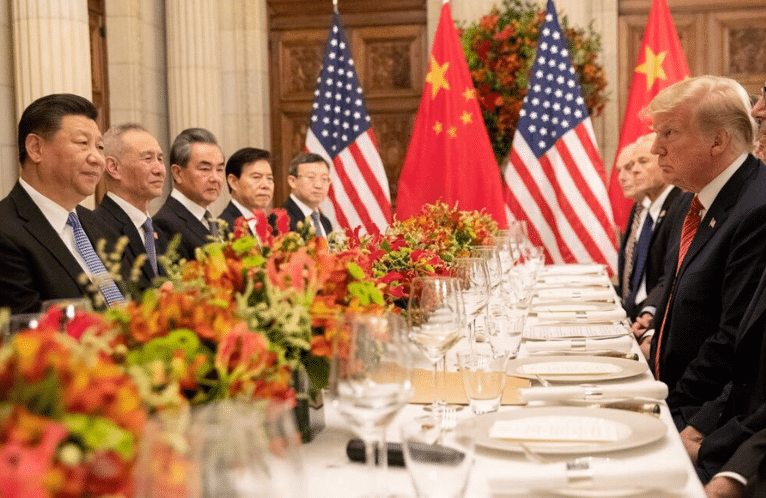

Chinese Investor Group to Buy Chicago Stock Exchange

Chicago Stock Exchange Inc, one of the oldest exchanges in the United States, on Friday announced its planned sale to an investor group led by China’s Chongqing Casin Enterprise Group.

The parties did not disclose terms of the deal, which is expected to close in the second half of the year.

If regulators approve the deal, this would be the first sale of a U.S. exchange to investors from China but not to a foreign entity. A unit of Germany’s Deutsche Boerse AG (DB1Gn.DE) purchased the International Securities Exchange in 2007.

Under new ownership, the Chicago Stock Exchange, which is known as CHX, would have the funding for efforts like revamping its listings program, Chief Executive Officer John Kerin said in an interview.

“They like our strategy, and they want us to continue to execute on it,” he said.

The 134-year old bourse plans to seek approval to list U.S. companies that want to access the capital markets but may not meet the standards of Nasdaq Inc (NDAQ.O) or Intercontinental Exchange Inc’s (ICE.N) New York Stock Exchange.

A long-term objective of Casin Group, a privately held company that invests in real estate development and financial holdings, is to list Chinese companies in the United States, Kerin said.

Casin Group is also considering starting an equities exchange in Chongqing in Southwest China using CHX’s model and technology, Kerin added.

Plans call for CHX’s management and business operations to remain in place. “Together, we have a unique opportunity to help develop financial markets in China over the longer term and to bring exciting Chinese growth companies to U.S. investors,” Casin Group Chairman Shengju Lu said in a statement.

CHX is a niche player in the U.S. equities market, executing about 0.5 percent of U.S. stock transactions.

The exchange, with locations in Chicago and New Jersey, is mainly used by market makers that buy and sell the most active exchange-traded funds and hedge their positions using futures on CME Group Inc’s (CME.O) Chicago Mercantile Exchange.

CHX plans to introduce on-demand auctions for large blocks of stock, called CHX Snap auctions, by the end of March and hopes to eventually triple its daily volume, Kerin said.

By JOHN MCCRANK with additional reporting by SUDARSHAN VARADHAN, edited by ANIL D’SILVA and LISA VON AHN. Feb. 5, 2016 on Reuters.

Read more here