Japan’s Prime Minister Takaichi Finally Says Something Close to What Beijing Wants to Hear

A Temporary Truce and the Long Road Ahead w/ USCBC’s Sean Stein

- Interviews

Juan Zhang

Juan Zhang- 05/27/2025

- 0

On April 29, at the height of escalating tensions in the U.S.-China trade war, the U.S.-China Business Council (USCBC) released its latest 2025 US Exports to China Report. The report warned that if the “U.S.-China Trade War 2.0” continues to intensify, it will severely impact American exporters and inflict greater losses on U.S. businesses, farmers, ranchers, workers, and consumers. “We urge leaders from both countries to come to the negotiating table and take immediate steps to remove or scale back these tariffs,” said Sean Stein, President of the U.S.-China Business Council.

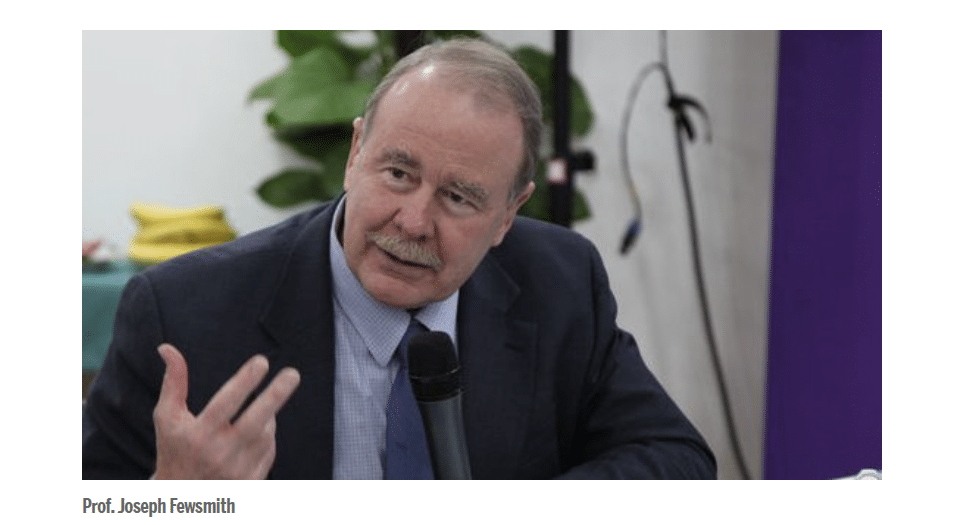

Roughly two weeks later, in a rare move, both the U.S. and Chinese governments simultaneously announced a temporary reduction in certain high tariffs imposed on each other’s goods, signaling a potential thaw in the deadlock caused by the ongoing tariff war between the two economic giants. In light of this unprecedented trade confrontation and USCBC’s timely report, we reached out to Stein for an interview.

Founded in 1973, the U.S.-China Business Council represents many of the world’s most prominent companies operating in China. For over five decades, the Council has consistently advocated for its member companies and has been committed to promoting mutually beneficial commercial relations between the United States and China.

Juan Zhang (JZ): The United States and China recently agreed to significantly lower tariffs following meetings in Geneva, with both sides pledging to continue negotiations. How significant is this development? Given the high-profile standoff leading up to the talks, what do you think brought both sides back to the negotiating table?

Sean Stein (SS): This temporary truce is extremely important for American industry, especially small businesses that were at their breaking point. It also made it possible for the United States to avoid most product shortages and some of the price increases that were coming for US consumers. That said, we’re still in a worse position than we were before April 2, when President Trump launched the reciprocal tariffs. For me, a key takeaway of the talks was that both sides acknowledged that decoupling is not in their interest—and I hope the last few months of trade panic will help bury that idea permanently.

We’ve got a long way to go before U.S.-China trade and the business relationships that have been upended can get back on track. So, while the situation is better now than before Geneva, a 90-day reset does not provide the predictability companies need to make significant investment or hiring decisions. This will hurt the U.S. economy.

JZ: While the drop from 145% to 30% tariffs marks a dramatic shift, some analysts argue that a 30% rate still imposes serious burdens on trade. Does the USCBC have a recommended target tariff rate? Are there particular sectors where the USCBC advocates for lower tariffs?

SS: For many companies and products, 30% is still trade prohibitive—and even where it isn’t, the resulting price increases in the United States will sting consumers and undermine U.S. competitiveness. Meanwhile, China’s retaliatory tariffs continue to hurt U.S. farmers, ranchers, and factory workers. One thing that should be abundantly clear at this point is that the shock-and-awe approach to China tariffs is not effective, and that blanket tariffs do more harm than good to the U.S. economy.

When carefully targeted and calibrated, tariffs can promote supply chain resiliency and national security. There is also an argument to be made that strategic, targeted tariffs on a narrow subset of goods could be used to blunt some of China’s unfair trade practices and industrial policy, though that would require a thorough investigation and consultation with industry. That’s not what we saw this time around, and the damage was immediate and severe.

JZ: In the 2025 Export Report, you emphasized the importance of lowering the “tariff temperature” as a first step, followed by addressing longstanding structural issues that disadvantage American businesses in China. Could you elaborate on the key structural challenges the USCBC would like China to make a change?

SS: Like President Trump, we want a fair and level playing field for U.S. companies in China, one where they are no longer at a disadvantage compared to their Chinese private or state-owned competitors. That means treating American companies the same when it comes to agricultural, biotech, and medical device approvals, as well as in public procurement, the distribution of landing slots at airports, and approval of electronic payment services. It also means rescinding public and private regulations that require companies to replace American ICT products with domestic ones and protecting U.S. intellectual property.

JZ: Some Americans believe that President Trump’s tariff policies will bring long-term benefits, such as reshoring manufacturing and reducing trade deficits, despite short-term costs. What would you say to those who support this approach?

SS: This is a timely question, especially now that Americans are seeing how trade policy can impact their retirement accounts, how much they pay for groceries, and whether a medicine they need is stocked at the local pharmacy.

It is critically important for the long-term health of the U.S. economy and for national security that some manufacturing be reshored to the United States. Tariffs can be an important tool to reach that goal, but only if they are used strategically and targeted with surgical precision. Blanket tariffs or tariffs that are not well-targeted or properly calibrated fuel inflation and create uncertainty—they don’t promote reshoring. So, before rolling out tariffs, the administration needs to define what kinds of manufacturing it seeks to restore. Only once that has been done can the work of setting tariffs actually begin.

JZ: The report highlights China as a vital market and growth engine for many U.S. companies. In light of growing calls for “de-risking” and supply chain diversification, what guidance do you offer to firms trying to develop long-term strategies for operating in or sourcing from China?

SS: These days, most companies operate in China so that they can sell into the China market. This is what we call an “in China, for China” strategy. For these firms, leaving China is simply not an option. However, companies have been strengthening their supply chains’ resilience to shocks, especially since the COVID-19 pandemic. It may sound counterintuitive, but they’re both diversifying away from and doubling down or localizing in China at the same time. The extent to which a company is pursuing either option depends on the sector and the company.

JZ: Education and cultural exchange have traditionally served as stabilizing elements in the U.S.-China relationship. While the report notes a rebound in Chinese student spending, the overall number of Chinese students in the U.S. continues to decline. How does the USCBC view the role of educational and people-to-people exchanges in the broader bilateral economic relationship? Do you have any specific plans to continue promoting education exchange between the two countries?

SS: As a diplomat posted in Asia for more than two decades, I could see clearly that much of U.S.-China relations actually rides on the people-to-people exchanges. Yes, it’s good for both economies, but more importantly, it helps us understand and build respect for one another. It makes us more likely to research, innovate, and solve global problems together and less likely to misread the other’s intentions. This is why USCBC advocated for the restoration of people-to-people exchanges post-COVID and for the re-establishment of Fulbright, Peace Corps, and other U.S. government exchange programs in China.

It’s always a pleasure to host delegations of students—the next generation of leaders—at our offices. For example, we recently welcomed undergraduate students from Tsinghua University visiting the United States at our DC office and likewise hosted graduate students from Johns Hopkins School of Advanced International Studies onsite in China. We’re also proud to co-sponsor and regularly contribute to academic and student conferences related to U.S.-China relations.

Juan Zhang is a senior writer for the U.S.-China Perception Monitor and managing editor for 中美印象 (The Monitor’s Chinese language publication).

The views expressed in this article represent those of the author(s) and not those of The Carter Center.

Author

-

Juan Zhang is a senior writer for the U.S.-China Perception Monitor and managing editor for 中美印象 (The Monitor’s Chinese language publication).