The Race to Win Mexico’s Favor

- Analysis

Miranda Wilson

Miranda Wilson- 02/15/2025

- 0

The Gulf of America

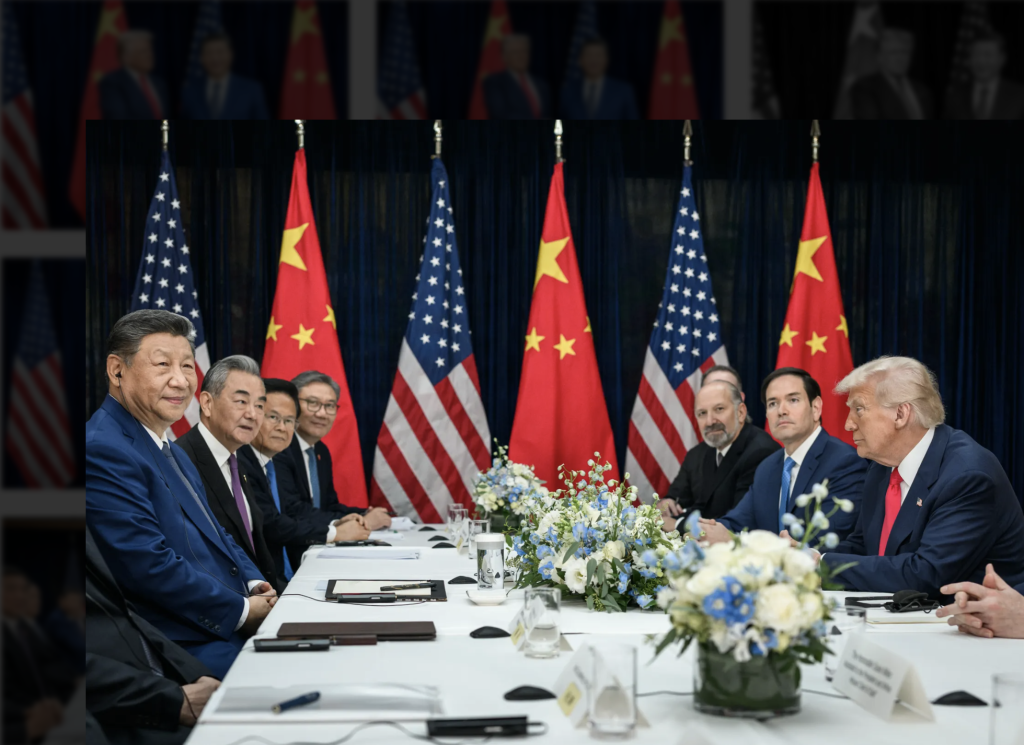

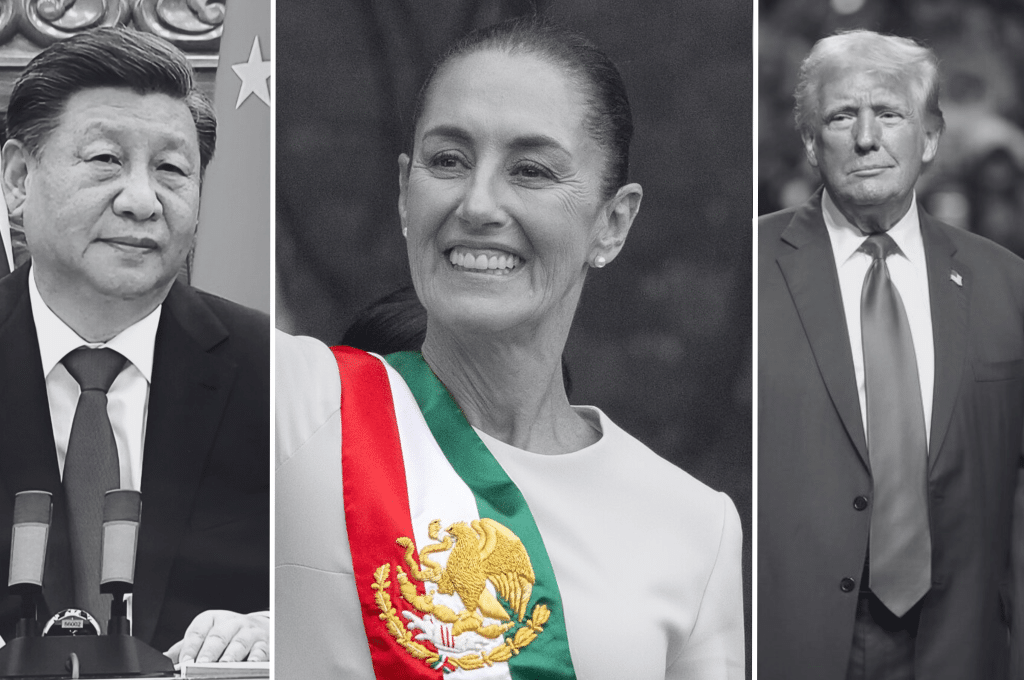

U.S.-China competition rhetoric is ubiquitous. The common prizes experts claim are at the finish line include global markets, technological leadership, and the world order. But, something else might be waiting at the finish line: Mexico’s partnership. Earning an alliance with Mexico comes with a variety of benefits – natural resources, geostrategic location, and a little over 120 million consumers. As Trump settles in for his second presidency, several key issues will continue to define the U.S.-China-Mexico trilateral relationship.

On issues like immigration and trade relations, Trump’s policies are likely to represent a marked shift from Biden’s, and, for now, it seems Mexico is trying to win America’s favor. Claudia Sheinbaum, Mexico’s first female president, has been cracking down on migrants and unveiling new tariffs that seem to target Chinese-owned companies like Shein and Temu. However, it’s unlikely Trump will show much gratitude for these efforts, as his mass deportation plans leave Mexico to host deportees and rejected asylum seekers from across the region. Trump has also threatened increased tariffs on Mexico and Canada, America’s two largest trading partners (China takes third place). Currently, China is pursuing improved economic and political ties with the Global South, which includes Mexico. As China’s foreign direct investment (FDI) in Mexico grows for the seventh year in a row, will Mexico give up on America and turn towards the East?

Immigration

Immigration is perhaps the most hot-button issue in American politics. The border and its crossing form not only the literal dividing line between the United States and Mexico but also potentially a metaphorical one. Right now, Mexico and the United States seem to be aligned on the issue. In the last year of Biden’s presidency, Mexico’s crackdown caused the number of migrants caught by U.S. authorities at the border to fall to its lowest level since 2020. During Trump’s campaign, Mexico itself was less of a target in his immigration rhetoric than his 2016 run, which, as one Mexican senior official alluded to, was the point: “Mexico is determined not to be the focus of the election.”

Illegal crossings remain high on the U.S.-Mexico border. While they declined in 2024 after reaching an all-time high in December of 2023, Trump has been able to stoke enough fear around the issue to keep it at the center of the American zeitgeist. In his first month in office, Trump cleared the way for authorities to begin removing more than a million migrants who were legally admitted to the United States under the Biden administration.

Chinese immigration to the United States is a small but important part of the issue. In 2023, more than 37,000 Chinese immigrants were detained for attempting to enter the United States illegally, more than the past 10 years combined (I wrote on this issue here). In the summer of 2024, Ecuador suspended an agreement it had with China to waive visas for Chinese citizens – an agreement that many Chinese migrants took advantage of. In late January, amid Trump’s deportation threats, Chinese Foreign Ministry spokesperson Mao Ning said, “As far as repatriation is concerned, China’s principle is to receive the repatriates who are confirmed as Chinese nationals from the Chinese mainland after verification.”

Mao Ning’s statement signals China is on the same page as the United States in terms of curbing illegal immigration. So, if everyone is aligned, what could go wrong?

While China is unlikely to be a major player in U.S.-Mexico immigration disputes, increased pressure on Mexico to handle migrants on their side of the border might sour Mexico’s attitude toward American leadership. Thousands of non-Mexican immigrants have been stranded in Mexico this month, overwhelming officials as they rush to raise tent cities, effectively creating a situation similar to a refugee crisis. Under Trump, migrants who had planned to seek asylum in the United States will now be required to wait for proceedings in Mexico (it is worth noting that Chinese migrants make up many of those asylum seekers). On his first day in office, Trump shut down the app CBP One, used by asylum seekers to schedule appointments at a U.S. port of entry. Some estimates claim the app closure stranded 200,000 mostly non-Mexican immigrants who were waiting for CBP One appointments.

President Sheinbaum said that Mexico planned to voluntarily return non-Mexican nationals to their home countries. The new immigration policies will undoubtedly cause tension between the United States and its southern neighbor as Mexico is left to pick up the pieces of an iron-tight border and asylum seekers’ shattered hopes.

Fentanyl

While China banned the production of fentanyl in 2019, it has not stopped China-based companies from profiting through a clever loophole: selling precursors of the drug. These companies sell fentanyl precursors to the United States and Mexico, where cartels and traffickers combine chemicals to sell the final product and other synthetic opioids throughout the United States.

Deaths caused by synthetic opioid overdoses in the United States are on the rise. In 2022, there were 73,838 deaths involving synthetic opioids. Solving the problem requires cooperation between all three countries involved in the supply-and-demand chain.

Biden and Xi made some progress on this issue. In November 2023, China agreed to restart cooperation with U.S. authorities to counter the flow of fentanyl. In January 2024, the U.S.-China counternarcotics commission was resurrected and held its first meeting. According to Brookings, “China has started acting on U.S.-provided intelligence about Chinese drug networks.”

U.S.-Mexico cooperation on illicit drug trafficking activity is hazier. Biden approved some money and resources to be donated to Mexico to help combat drug trafficking, and there have been several diplomatic meetings to address the issue. However, the United States’ War on Drugs, started under Nixon, has a long and complicated history that has understandably caused Mexico to be distrustful of U.S. operations in its territory.

While there was some hope for cooperation to improve under Biden and Sheinbaum, Trump’s inflammatory rhetoric about Mexico “not sending the best people” might further hinder cooperation on illicit drug trafficking. To give another example:

“They’re rough people, in many cases from jails, prisons, from mental institutions, insane asylums. You know, insane asylums, that’s ‘Silence of the Lambs’ stuff. ... Hannibal Lecter, anybody know Hannibal Lecter?”

He has taken a forceful approach to stopping the flow of fentanyl in both Mexico and China, threatening tariffs on both countries (as well as Canada) to gain leverage on the issues of the illicit fentanyl trade and illegal immigration. On February 3rd, Trump agreed to a 30-day pause on the Mexico and Canada tariffs. The pause allows for a negotiation period in which Mexico and the United States will negotiate over how to limit drug smuggling.

The 10% tariff on Chinese imports, however, is now in effect. The Executive Order states:

“The Chinese Communist Party (CCP), which exerts ultimate control over the government and enterprises of the PRC, has subsidized and otherwise incentivized PRC chemical companies to export fentanyl and related precursor chemicals that are used to produce synthetic opioids sold illicitly in the United States.”

It continues:

“The PRC plays a central role in this challenge, not merely by failing to stem the ultimate source of many illicit drugs distributed in the United States, but by actively sustaining and expanding the business of poisoning our citizens.”

While China had shown a willingness to work with the United States on fentanyl under Biden, this strongman approach from Trump is a bad sign for any future hopes of collaboration. Beijing has already hit back with a 15% tax on certain types of coal and liquefied natural gas and a 10% tariff on crude oil, agricultural machinery, large-displacement cars, and pickup trucks, which took place on February 10th. It seems that a deal similar to the one the United States reached with Mexico and Canada is not in the cards.

Trade, Nearshoring, & FDI

Since 2018, China’s foreign direct investment in Mexico has grown at an average annual rate of 50%. Shipments to Mexico surged 60% last year, and China sells a fifth of all its new automobiles to Mexico. The two countries had a $93.8 billion trade deficit in 2018, with Mexico exporting $8 billion worth of goods to China and receiving $101.8 billion in goods.

While the economic relationship between Mexico and China is undeniably increasing, the United States has shown discomfort with the growing amount of imports. For now, Mexico seems to be prioritizing the appeasement of Trump. Sheinbaum recently rolled out an economic plan aimed at curbing imports from China and gave a speech defending the U.S.-Mexico-Canada (USMCA) trade pact which is up for review in 2026. She specifically said the trade pact is the only way to compete with China. Mexico’s agreement to work with the United States on fentanyl as a way to delay tariffs also suggests their determination to keep trade relations high.

The United States also has a vested interest in maintaining a positive economic relationship with Mexico. In 2023, Mexico surpassed China as America’s biggest trading partner (Mexico accounts for 15.8% of total trade, Canada 14.3%, and China in third place at 10.3%). Part of this shift in top trading partners is due to American efforts to prioritize nearshoring. American businesses are moving their operations to neighboring countries like Mexico and reducing their reliance on Chinese production. Apple, for example, announced its intention to slowly move manufacturing away from China in 2022, and production centers have been multiplying in Mexico ever since. Tesla is also building a new production plant in Northern Mexico. In total, 78% of Mexico’s exports go to the United States.

Economically, it makes sense for Mexico to bend to the United States in order to keep trade alive and set the stage for an improved USCMA trade pact in 2026. As China and the United States gear up for another trade war, Mexico could continue to welcome American business production, boosting its economy and creating jobs. However, Trump only agreed to pause the tariffs on Mexico and Canada for 30 days. If the 25% tariff does go into effect, it could be a huge blow to Mexico’s economy (and America’s and Canada’s).

If the relationship sours, Scott Morgenstern, professor of political science at the University of Pittsburgh, told the New York Times, “Mexico could turn to Washington’s biggest economic rival at a time when Beijing is seeking to assert more influence across Latin America.”

China seems to be preparing for that possibility. In 2023, Chinese FDI in Mexico reached a 13-year high, totaling$5.6 billion. The Rhodium Group found that this number could be six times higher than the official reports due to distortions in FDI data and investments through offshore entities in places like Hong Kong. American FDI is still higher ($33.8 billion in 2022) but has the potential to decline under Trump. During his first presidency, U.S. FDI to Mexico shrunk 19.6%. While some of this decline was due to the pandemic, the long-term trajectory still predicted a major decrease. Under Biden, global foreign investment to Mexico rose to 25%.

It is not hard to imagine a world where Mexico gets tired of the flip-flop of American politics and its impact on the Mexican economy. If Trump harms nearshoring efforts, holds true to his promise of tariffs, or refuses to negotiate a beneficial USCMA, Mexico could turn towards China for a brighter economic future.

Technology

Seventy-two percent of Chinese FDI in Mexico is in the form of automotive investments. The United States’ biggest national security concern with the growing China-Mexico relationship has to do with digital components of manufacturing. Both Trump and Biden have expressed concern on this issue. Trump has suggested tariffs of 200 to 500% on vehicles from Mexico and Biden proposed a ban on Chinese hardware and software in connected cars on U.S. roads.

In fact, ten firms identified by the U.S. Department of Defense as linked to China’s military apparatus are active in Mexico. Huawei is one company making its way into Mexican infrastructure. Felipe Ángeles International Airport openedin Mexico City in 2023 and utilizes a smart modular data center created by Huawei. Huawei has increased its activity across the entire Latin and Caribbean region, making up a third of all 5G tests conducted in the region.

The United States has expressed numerous security concerns with Huawei and other Chinese technology companies. According to a 2022 Department of Defense report, the PRC has used the information space to steal industrial and defense secrets, spread misinformation to undermine democratic institutions, and suppress dissent both domestically and internationally. The latest drama over a TikTok ban is the most recent example of U.S. national security concerns over Chinese tech, although Trump seems open to negotiation on that front (China, not so much).

Unless Mexico makes an effort to decrease China’s digital influence, the technology issue could further create tension between the United States and Mexico. If the United States believes Chinese digital influence over its southern neighbor causes too much of a security threat, the steps it takes could be drastic. America could continue to place high tariffs or even bans on Mexican goods it believes were built with Chinese technology or enforce greater measures to protect against cyber espionage. Whether a deal can be struck over TikTok might tell us more about how the U.S.-China technology race will unfold.

Ultimately, Whose Gulf is It?

Perhaps the most symbolic representation of U.S.-Mexico relations is Trump’s renaming of the Gulf of Mexico. In case you somehow have not heard, a new executive order declares it shall now be the Gulf of America. It seems that Trump is going to do whatever he believes is in America’s best interest no matter how petty, and Mexico will have to pick its battles, adapting to America’s vision of the Americas or forging a different path.

Right now, as Mexico works with the United States during the 30-day pause on tariffs and takes measures to limit Chinese economic dependence, it seems they have chosen the first option. Geographically, the United States will always have the upper hand in winning Mexico’s loyalty; it’s better to appease a next-door neighbor, even if it means worsening a relationship an ocean away. However, Trump could push Mexico to look across the Pacific as tensions grow over trade, immigration, drug trafficking, and technology. China seems to be laying the groundwork for a stronger relationship with Mexico and Latin America, willing to play the long game as the steady tortoise in comparison to the unpredictable hare.