Remembering Joseph Fewsmith: The Passing of a Generation of China Hands

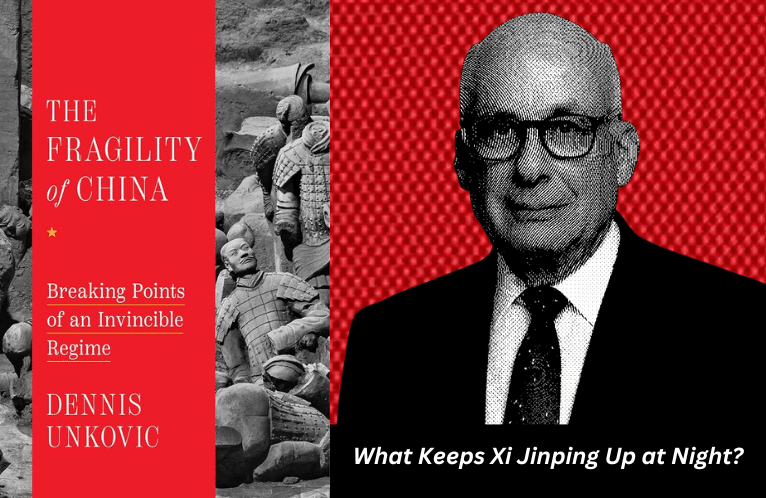

What Keeps Xi Jinping Up at Night? An Interview with Dennis Unkovic

- Interviews

Miranda Wilson

Miranda Wilson- 09/19/2024

- 0

Will the 21st century be the “Chinese century”? In his new book, The Fragility of China, Dennis Unkovic argues there are many problems China must first overcome. From a declining population to a broken global supply chain, we ask Mr. Unkovic exactly why China might not be as economically strong as we think. His book discusses 13 MaxTrends® that can otherwise be referred to as the pressing issues that keep Xi Jinping up at night. Some of the challenges China is facing sound familiar to Americans: a housing crisis, for example, and others will likely directly impact the United States, such as competition over tech innovation. For this reason, Unkovic concludes: “The biggest challenge for America going forward is China.”

Dennis Unkovic is a senior partner with the law firm of Meyer, Unkovic & Scott LLP. He frequently briefs business executives, trade associations, and government leaders on high-profile issues, and negotiates complex commercial transactions, including international mergers and acquisitions and joint ventures as well as advising on inbound and outbound investment projects. He has traveled to 65+ countries over his career, with significant involvement in China, India, Japan, Korea, Southeast Asia, and Europe. A prolific writer, he has authored, edited, and contributed to numerous books, and written articles for both domestic and international publications. His newest book is The Fragility of China: Breaking Points of an Invincible Regime (Encounter Books, July 2024).

Miranda Wilson: Your book opens with a discussion of Xi Jinping and his rise to power. You call him “the most powerful leader in the world” and describe his total control over the Chinese government, economy, and military. Do you think Xi Jinping’s total control is more of an asset or detriment to China’s future?

Dennis Unkovic: In my book, I describe why Xi Jinping is so powerful. I make an analogy to a stool: if you have a stool with three legs and they’re equally sturdy, it can essentially hold anything. It’s a strong stool. In China, there are three major power centers: the CCP, the military, and the economy. Xi Jinping is in charge of all 3.

In theory, if you have one person who is omniscient and he or she always makes good decisions, then it’s a good thing. But Xi Jinping over the last 10 years has made some tactical decisions for which China has paid a very heavy price. So, do I think any autocracy is good? It’s sort of like the old joke: I don’t care who runs the country as long as I have a king or queen who prioritizes my interests first. Well, that isn’t what happens with most autocrats. Most autocrats learn how to exercise power, and the longer they’re in power the more they only assert their own ideas. In short, having an autocrat run the country is not good for China.

MW: The rest of your book focuses on 13 MaxTrends® that pose significant challenges to Xi Jinping and China’s leadership. For those who have not read the book, could you briefly define MaxTrends® and explain why this is how you chose to evaluate China’s fragility?

DU: I think when you’re writing or even speaking, it’s helpful to have a word that encompasses what you’re trying to say. MaxTrends® is a word I made up that identifies a development or an event that has the potential to impact a country and its leaders. MaxTrends® are 13 developments that I think have a major impact on China. The United States has its own MaxTrends®, but there are a lot of people who have said China is invincible and we’re in big trouble. Some authors have written the 21st century will be the century of China. I don’t agree with that. It’s possible, but I hope to point out to my readers that there are things that Xi Jinping simply can’t control. It’s how these external factors, which I identify as MaxTrends®, will affect what’s going on in China.

MW: The first MaxTrend® you describe is population. I think for some, it seems counterintuitive that population is an issue for China considering over 1.3 billion people live there. Could you elucidate why the population issue China is currently facing is so problematic?

DU: In the 1960s when Mao was in power, he essentially destroyed the Chinese economy. Millions of people starved to death during the 1960s Mao era because of certain policies. Afterward, when Mao died, there was great pressure upon his successors to grow the Chinese economy. Another influence was a 19th-century philosopher, Thomas Malthus, who had a theory that the world would end because people would continue to have more and more children and outrun the food supply. We now know Malthus was wrong, but China, as it tried to build its economy, held back on having children. They established the One Child Policy: if you were a woman and of childbearing age, the government said you could only have one child. The policy was very strongly enforced. Women would not have a second child supported: if their husbands were working, they could lose their jobs.

The One Child Policy was so effective that in 2022 and 2023 China has had its population decline, not increase. There have been projections that this decline will continue into the future. A population has to have about 2.1 children born per family on an ongoing basis to keep a population stable or about the same. One study projects China’s population could shrink to only 770 million by 2100. This is something China is concerned about. What happens if you don’t have enough children? You don’t have enough workers.

The other thing that plays in here is retirement policies. Traditionally, you will retire in China when you are 55. There are increasing numbers of Chinese people who are over 60 and have retired. As a matter of fact, if you are a woman working in a blue-collar job, the retirement age is closer to 50. That’s a real demographic problem. China’s facing increasing numbers of old people and they’re not producing enough young people. If your population’s going to shrink by half in 80 years, you’re not going to have enough workers.

Also, those who are working are going to have to support the older people who are living longer. Traditionally, in China, if you were over 50 or 60, you would live with your children and they would take care of you. The younger Chinese people today are different. They’re living in dense urban areas where it is expensive, so taking care of aging parents is more difficult.

In the United States, we have social security, insurance, and options for people to support themselves after retirement. China doesn’t have a social security net protecting people. Some companies pay little pensions, but a lot of the people who are over 60 and retired would depend on their children to live in a communal area and hopefully would’ve saved a little bit of money.

MW: Why are Chinese families choosing not to have more children? Is it specific to China or does it reflect global trends?

DU: The same problem I have just spoken about in China about not having enough children is occurring in Japan and in Korea it’s even worse. The birth rate in Korea is only 0.8. So, yes, this is not just a China-based problem, but China has grown by being a major manufacturing center that requires lots of workers. This MaxTrend® is also going to affect China the most because China’s leaders demand political stability. They’ve maintained political stability because their standard of living has been consistently rising. The standard of living cannot continue to rise in China if they’re not manufacturing enough goods. The other thing is, women who have a university education and good jobs are often electing not to have as many children. This has nothing to do with China’s One Child Policy.

MW: MaxTrend® #5 pertains to the global supply chain. Do you think China’s decreasing role as the global manufacturer is potentially a good thing? Could a transition away from low-cost manufacturing actually be beneficial for long-term growth?

DU: I think China doesn’t have a strong enough consumer base for that to be a possibility. In the United States, for example, most of our economy is driven by demand from the 330 million Americans buying things. In China, they don’t have as large of a middle class that is purchasing goods. If Xi Jinping had his choice, he would have fewer manufactured products. He would want more technology-based products because it requires fewer workers. But there is not the base in China today, even though Xi Jinping for three years has been trying to encourage the average Chinese worker to buy more. A couple of weeks ago they announced some policy saying, “Isn’t it time to buy a new refrigerator or upgrade your home appliances?”

And so, yes, if they became less manufacturing-oriented, that would be good in the long run, but it seems like they do not have a strong enough consumer base. Which is why China is now dumping many of its goods worldwide. If factories are producing more than they can sell, what do you do? You can lay off workers, but Xi can’t do that. Because in a society, if you lay off workers, you have political problems. So what you do is keep producing goods and then dump them around the world at below the cost of production.

An example of this is EVs or electronic vehicles. These are being produced in mass numbers in China, but Chinese consumers are not buying enough of them. So, China is dumping them around the world at prices that are less than the actual cost of producing them. If you’re a consumer, that’s a great deal. If you’re going to sell me a $20,000 EV vehicle for $12,000, I want to buy it. But if you’re one of the European manufacturers, Mercedes-Benz or Fiat, for example, that’s frustrating because you can’t compete.

MW: Why is China’s role in the global supply chain decreasing?

DU: Let me give you an example, I’m wearing a mechanical watch here. It has 120 pieces and as long as it runs it’s fabulous. However, what happens when an internal spring breaks? My watch is useless It’s a piece of metal that doesn’t tell the time. That’s what happens with the global supply chain.

It’s really nice to be able to order goods online assuming they’re delivered in a timely manner right to your doorstep. COVID disrupted this process. For China, in 2020, their manufacturing dropped precipitously because they couldn’t make things during the pandemic. In Europe, the United States, and South America, all these components they were expecting didn’t come. There was a supply chain crash. The global economy went through a very difficult 24-month period. We’re sort of out of it now, but the global supply chain is still flawed.

I can give you an example. I did legal work for a company in New Jersey. They sold a product that was basically a black box containing a bunch of electronic components. It sold for like $1,400. I was contacted by them. They said, “Hey, we have a problem. We need this one component here. We are having trouble getting it from China. They keep saying it’s coming next week, but it’s been months.” I actually had someone in China go and check the company. Do you know what they found? The company was closed. So, the New Jersey company couldn’t sell these $1,400 black boxes all because they were missing a $35 part. It sounds crazy, but the thing didn’t work without the $35 part. That happened again and again in the United States.

It could happen again if a new strain of COVID came out this fall and Chinese manufacturing companies had to close down for 6 months again. We would be back in the same situation. The companies who want their stuff manufactured in China because it’s cheaper than the US are now forced to face the serious question of how and where they should source materials.

MW: Whether it be due to another pandemic or worsening political ties between the United States and China, do you think the United States should try to decouple its manufacturing from China? Is that even possible?

DU: Do you have an Apple phone?

MW: Right here.

DU: Okay, you’re holding one up. Where are most of these Apple phones manufactured and put together? China. A company like Apple can’t decide overnight they are not going to make products in China anymore. But companies like Apple have begun to seek out alternate sources. Some components for Apple products are now made in India, not China, because the United States has very good political relations with India.

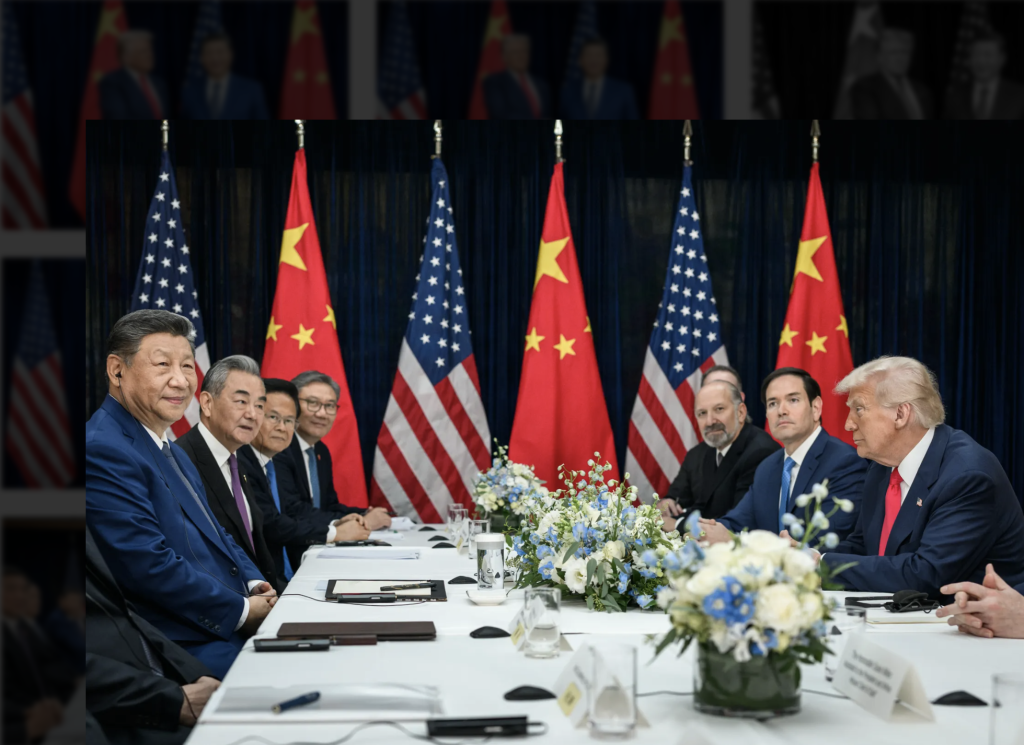

My book essentially projects that the relationship between China and the United States, at least for the foreseeable future, is not going to improve. I don’t believe there’s going to be a war between China and the United States, but the more difficult it is to do business with a company in another country, the less likely you are to keep collaborating. It’s a learning process, but the global supply chain is still broken. The supply chain still represents a significant risk to people who are doing business globally.

Right now, it looks better to consider making components closer to the United States. Originally the strategy was called offshoring. For example, I’m not going to make it in the United States, I’m going to offshore it to China. The term that’s now used is reshoring. Countries like the United States are reshoring manufacturing closer to home. Mexico has seen a lot of growth as a result of these reshoring efforts. Although it’s cheaper to make things 12,000 miles away, time is money, and products made in Mexico can make it to the United States much faster than products in China.

MW: Let’s move on to MaxTrend® #4, the RMB. Your book gives an interesting analysis of why currency keeps Xi Jinping awake at night, but I am curious about what you think the ultimate fate of RMB will be. Will it ever surpass the dollar?

DU: A little bit of background: the most important thing in business is to have the ability to convert one currency easily into another. The U.S. dollar is the global currency still used today by almost all countries. The euro, the Japanese yen, the Korean won, are all convertible to the U.S. dollar. That’s how the system works.

China has essentially hurt itself by tying its currency to the U.S. dollar. China has one currency, but it has two names: RMB and yuan. By fixing the rates of the dollar to the RMB, China has stacked the deck in its favor. For years, China has been able to essentially make its products more attractive to foreign buyers because they could adjust the price to where they wanted it. However, by fixing their currency, they have made it very difficult for other non-Chinese companies to do business there.

Your question to me is: is the dollar going to remain the primary currency globally? My answer is yes. Nobody in the world today wants to have profits earned in China and denominated RMB and then have to have the permission of the Chinese government to convert them into U.S. dollars or euros.

How can you be the most powerful country in the world and have a currency that doesn’t work in the global trading system? That’s a big problem for China. Could China change that tomorrow? Yes, Xi Jinping could say, “I’m going to make my currency fully convertible.” What’s the problem he faces as an autocrat? External forces could affect the value of it. Xi would have less control over his economy. I see no intention of Xi Jinping to change it.

MW: MaxTrend® #11 is technology. Do you think there will ever be a reconciliation between Western and Chinese technology companies?

DU: One of the challenges that China is currently facing is while Chinese manufacturers are making a lot of components for technology-based products, they are still based on Western technologies like Apple phones. I think that Xi Jinping would like China to develop its own indigenous technology, and they’re making a lot of efforts to do that. For years, China has been pursuing a project called “Made in China 2025.”

10 or 20 years from now, I predict we’re going to have a “two-technology world.” We’re going to have Chinese-based technologies on the one hand and Western technologies on the other. That’s going to be a problem for the world because at a certain point, if you’re a big trader with China, you may be required to accept goods that have Chinese-based technologies. Also, it’s clear that there are national security implications to owning a technology. The current Biden administration has already attempted to restrict what technologies can be exported out of the United States.

At the end of the day, I see the relationship between China and the United States becoming worse because both sides are going to try to develop their own technologies. That’s a real challenge that I do not see being solved in the short run. It will contribute to increased tensions between China and the United States.

MW: Do you think the United States will ever let Huawei or other Chinese tech companies’ cell phones be sold in American stores?

DU: China announced six months ago, that Chinese workers who work in the Chinese government were being encouraged to buy “Chinese-based” phones from companies like Huawei and not to use Apple products. If the Chinese government said to its workers that they may never again buy an Apple phone, then Chinese workers would not be able to buy the phone. Do I see that happening in America? Far less likely. But if it was proven that a Chinese phone was collecting data on Americans, then the US might see it as a national security concern. It’s a whole new world.

MW: As a thought experiment, what do you think are the most pressing MaxTrends® for the United States?

DU: The most immediate challenge we must control is artificial intelligence. While we know what artificial intelligence is, we do not know its potential. The concern is artificial intelligence will no longer controlled by those who created it because artificial intelligence basically allows computers to think on their own and create content. For example, we’re in the midst of a presidential election in the United States, and there’ve been lots of examples of where artificial intelligence is being used to create false narratives. That’s a really serious challenge to democracy because we prize the opportunity for diverse opinions to come about.

For a pluralistic society like we have in America, that’s a MaxTrend® we must get a handle on. It has to be almost as important as anything else because it bleeds over into, for example, the military. Today drones are directed by someone on the ground. However, drones are now being given the capability to essentially make decisions on their own. An AI algorithm might decide it doesn’t want to drop the bomb in one place, but rather in a different place. It’s something that a lot of smart people are going to be thinking about in the future.

MW: I saw a New York Times article the other day about the worsening housing crisis in China. For American readers, is what’s happening in China at all comparable to what happened in 2008 in the U.S. housing market?

DU: What’s happening in China today is worse than what happened in the United States. Real estate takes up about 17% of the U.S. GDP. In China, a third of the Chinese economy is based on real estate. To put it in perspective, China’s economy used to grow between 6% and 12% per year. Since Xi Jinping took power, it’s been growing at around 6% and now less. Chinese economists have been predicting their economy’s coming back. It is not coming back at all. They will be lucky if it grows at 4.6% in 2024. When you have 1.3 billion people, your economy must grow at a certain level just to remain stable. That’s not happening in China today. I’m not exaggerating. There are millions of housing units in China that are empty because they can’t be sold. If the economy’s not doing well and you have limited resources, what are the chances that you’re going to want to buy an apartment or condo?

MW: How should U.S. foreign policy leaders understand your book? How should it influence U.S. policy towards China?

DU: Obviously, the world is facing many problems today. For example, what’s going on in the Middle East, Africa, and Ukraine. But the biggest challenge for America going forward is China. China must be the number one priority of American politicians, those who work in government, and also for companies. I have visited China 50 times in my life, so I have respect for the Chinese people, but their government as it exists now is very controlling. That’s a challenge for America now. But will this be the Chinese century? It could be, but I don’t think so. What America needs as a country is to say: “We have lots of problems, but don’t forget about China.” I want us to have a balanced look at China.

Thanks to The Carter Center for inviting me today. At the end of the day, global peace is something we all want and need. As a result of that, understanding China might be the most important piece.

Miranda Wilson is a senior at Emory University and contributing editor for the U.S.-China Perception Monitor.

The views expressed in this article represent those of the author(s) and not those of The Carter Center.