China’s Pork Crisis and the US-China Trade War

By Robin Fu.

Half of the world’s pork is consumed in China, and Chinese individuals on average consume 120 pounds of pork a year. Undeniably, any change in the price of pork will have significant impacts on China’s social climate. The price of pork, however, has been on the rise for the past few years in China. Pork serves as one of the key indicators for prosperity in China due to its importance in Chinese diets and its relative affordability (in most cases) for the middle-class. With the 70th anniversary of the People’s Republic of China approaching, the Communist Party of China (CPC) is worried that these prices may brew social discontent and market panic during the most important event on their political calendar this year.

Pork price began to inch up since 2017. In that year the Chinese government began to close household and small-scale pig farms as part of its 3-year environmental campaign to work towards a cleaner society. Small farms accounted for 90% of the total pig farms in China and 1/3 of China’s overall pork supply. This caused a 16% increase in the price of pork from June 2017 to November 2017.

Pork prices began to increase even higher when African Swine Flu (ASF) reached China. In August 2018, China reported its first case of ASF in Shenyang, a northeastern city. ASF is a highly contagious disease in pigs that, while harmless to humans, can kill a grown pig in 2 to 10 days. The World Organization for Animal Health states that any outbreak of the disease must be reported to the organization. Farmers attempted to quarantine the diseased pigs to stop the epidemic from spreading. China farmed ½ of the world’s pigs, and many neighboring nations such as North Korea, Vietnam, Laos, and Myanmar relied upon its supply. Justin Sherrard, an animal-protein strategist with Dutch bank Radobank, noted that smaller farms were most vulnerable to the virus. Managers of larger-scale industrialized farms tended to understand the virus better. Many smaller farms in China feed various food scraps to their pigs, a practice that can spread the disease. This practice was banned in provinces afflicted with ASF since September 2018 but continues to persist on smaller farms.

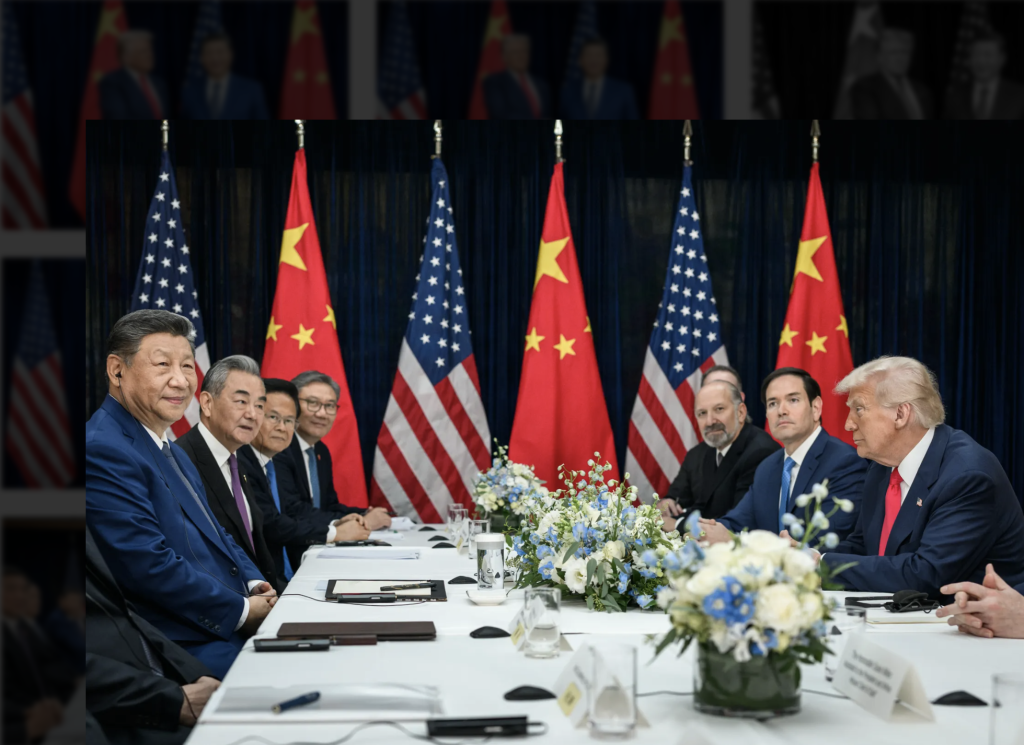

This pork price increase is also partly driven by the US – China trade war. As of September 1, 2019 China had imposed 72% tariff rate on U.S. pork imports. Prior to the trade war, although China produced 95% of its pork domestically, the U.S. still accounted for 1/3 of China’s foreign pork imports. As a result, U.S. offal imports (pig ears, elbows, innards, etc.) decreased by 55% and muscle cut imports decreased by 2%. Without the tariffs, Chinese suppliers could have chosen to import more pork from the U.S., to offset the decreased supply of pork produced domestically.

China’s environmental campaign and the onslaught of ASF have combined to create a huge price jump in pork. Li Shuilong, president of the China Meat Association, estimated that China’s pork production may drop by 15% to 20% in 2019. Chinese government retaliation against US tariff war through imposing tariffs on US pork has aggravated the situation. As a result of the pork shortage, pork prices in China have skyrocketed. Towards the end of August 2019 they were on average 46.7% higher than they were a year ago. In some regions, prices have doubled in August alone. Instead of the trade war or the Hong Kong protests, pork prices have dominated China’s social media.

The price of pork was so high that at the end of August, China’s premier, Li Keqiang, called for an “attitude of emergency” to combat the issue. Chinese authorities have ordered farmers not to feed food waste to pigs, and many have imposed transport restrictions and quarantines on infected pigs. Farmers have also been told to cull infected pigs to prevent the disease from spreading. Official reports indicate that 1/3 of China’s herd had been culled, but insiders report that as much have been killed. Several farmers have been arrested for concealing infection, selling contaminated pigs, or dumping carcasses to dodge slaughtering costs. The government has also ordered banks to provide loans to fund initialization costs for new or expanding pig farms while offering subsidies to these same groups. At least four regions, home to 130 million people, have begun to use their frozen pork stocks to stabilize pork prices and boost supply. Established in the 1970s, these pork stocks were created for special emergencies. The central government has its own reserve of frozen pork and live hogs that have not been used.

On September 13th, 2019, the Xinhua News Agency announced that China will exclude US pork and other farm goods from additional tariffs. This was in response to the U.S.’s decision to postpone additional tariffs from October 1 to October 15 as China will celebrate the 70th anniversary of the founding of the nation. Although the 72% tariff on frozen pork remains in place, some businesses are still purchasing certain amounts of pork and other farm products from the US. There is hope for some progress towards the end of the trade war as “goodwill gestures” were exchanged between the two nations. Shen Jianguang, a veteran Chinese economy watcher and chief economist at JD Digit, noted that neither side wants to escalate the trade war further. Still, he notes, it will be difficult to address the structural concerns regarding China’s economy. These structural concerns are at the core of the trade war, and negotiations will need to address these issues to end the conflict.

We do not know for sure if China’s decision to remove American pork from further tariffs is part of its effort to control the pork price. Although pork imports from the US account only for a very small portion of China’s pork overall supply but for American farmers China is one of the biggest buyers of pork and related products. When both sides need a path to move away from the cliff of further trade confrontation, China’s extending of an olive branch has created an opening for both sides to avoid a crisis that may have huge political and economic ramifications. In 1971, it was ping-pong diplomacy that led to the icebreaking between US-China relations. In 2019, it may be pork diplomacy that prevents Washington and Beijing from digging a pit too deep for either to climb out.

Robin Fu is an intern at The Carter Center’s China Program. The views expressed are those of the author and do not represent those of The Carter Center.

References:

Alexandra, Stevenson, and Zhong Raymond. “China’s Pork Prices Soar, Adding to Beijing’s Troubles,” September 10, 2019, sec. Business.

Anna, Fifield. “Soaring Pork Prices Pose Dilemma for China’s Rulers.” The Washington Post, September 9, 2019.

Dominique, Patton. “China’s U.S. Pork Imports Plunge in 2018 as Trade War Bites.” Reuters, January 25, 2019.

Hallie, Gu, and Mason Josephine. “No Joke: China’s War on Pollution Roils World’s Top Pig Farming Sector.” Reuters, November 4, 2017.

James, Palmer. “Why China’s Leaders Are Losing Sleep Over Pigs.” Foreign Policy (blog), September 11, 2019.

Jiefei, Liu. “Update: Surging Pork Prices Fuel Consumer Inflation in August.” Caixin Global, September 10, 2019.

Laura, He, and Wang Serenitie. “China Is Starting to Eat into Its Emergency Reserves of Pork.” CNN, September 12, 2019.

Lucca, Paoli, and Medetsky Anatoly. “Can China Learn from Russia and Save Its Pigs from African Swine Fever?” South China Morning Post, December 7, 2018.

Mandy, Zuo. “China Culls 900 Pigs after Reports of First African Swine Fever Outbreak in Country.” South China Morning Post, August 3, 2018.

Orange, Wang. “Hong Kong Protests and US Trade War No Longer China’s Top Priorities as Spiralling Pork Prices Dominate Agenda.” South China Morning Post, September 10, 2019.

Zhou, Xin. “China to Exempt US Pork and Soybeans from Further Chinese Tariffs.” South China Morning Post, September 13, 2019.