“American Carnage”: The Illusion at the Heart of Trump’s Trade War

The American manufacturing industry is a victim of its own efficiency. Blaming the Chinese detracts from the fact that better technology and organization is the actual reason why so few Americans work in manufacturing. A trade war with China will not revive American manufacturing because it does not address the fundamental drivers of the crisis.

On Tuesday, April 10, 2018, President Xi delivered a keynote address for the 2018 Boao Forum for Asia in Hainan, which ran through Wednesday, April 11, 2018. Many commentators correctly interpreted the speech as primarily tailored to capitalize on the opportunity arising from the U.S.’s withdrawal from the TPP and deepen partnerships with its Asian neighbors. To this effect, the idea that China should build a community of shared future for mankind is figured prominently in the speech.

The other important part of the speech was intended to assuage the Trump administrations’ concerns regarding Chinese trade practices. President Xi stated his intention to reduce automobile tariffs by the end of the year and repeated his promise to give foreigners expanded access to financial markets. The explicit reference to car tariffs is likely a strategic response to a Trump tweet released earlier that day, which stated that Chinese tariffs on cars typify the unfair trade practices his administration seeks to correct (see below). Though Trump’s tweeting habits are generally impulsive, his focus on cars was not random. The decline of manufacturing in the Rust Belt, formerly the heart of the American auto industry, is widely regarded as fueling Donald Trump’s appeal in crucial Midwestern states. Perhaps nobody understands this element of support better than President Trump.

China’s Assurances: Déjà vu All Over Again?

President Xi’s assurances at Boao should seem familiar. Right after the Trump administration announced its plan to slap tariffs on steel and aluminum at the beginning of March, China’s top economic adviser, Liu He, was sent to Washington to prevent that action from escalating to an outright trade war. On March 1, Liu He met with Trump’s now-departed Chief Economic Adviser, Gary Cohn, to outline how China planned to give foreign firms greater access to China’s markets, especially in finance sectors such as insurance.

Liu He’s statements to administration officials reflected growing frustrations within the business community regarding inaccessible Chinese markets. During his visit to the U.S., Liu He also attended a small meeting with U.S. business executives. One attendee of that meeting, Jacob Parker, the VP of China operations at the US-China Business Council, reported to The Wall Street Journal that the overall message to Mr. Liu was, “Business is losing confidence in China’s policy direction.”

Similarly, The New York Times reported at around the same time that many businesses, historically a moderating force against political pressures to be tough on China, are concerned by the recent turn in the business environment within China. Some firms are even considering cutting their losses. For example, German executives, whose companies have been particularly shrewd at cultivating extensive ties with China, are beginning to worry that their presence there may be like a frog who does not realize it is in a boiling pot until it is too late. If businesses leave China en masse, they may be less inclined to strongly resist populist policy proposals coming from the Trump administration.

Understanding the consequences of U.S. business hostility, President Xi echoed Liu He’s earlier commitment at Davos earlier this year to “a new phase of opening-up” in the Boao speech. At Davos, Liu announced that the Chinese government intended to commemorate the 40th year anniversary of Open-up and Reform by launching more forceful measures that meet the new challenges present in the Chinese economy.

Reacting to President Xi’s speech, many business leaders noted that this is not the first time that Chinese leaders have ambitiously promised to open-up its financial markets. Overall, they implied that Chinese track record of reform has not lived up to what leaders say in well-crafted public addresses.

The skepticism among the business community is well-grounded in a few respects, but it also misses how the Chinese government has begun to add teeth to their proposals. Last Tuesday on April 10, China’s top central banker, Yi Gang, clarified the timeline for President Xi’s pledge to open financial markets. Yi announced that the deadline to roll back foreign ownership caps on securities and insurance companies would come sooner than many expected at the end of June of this year. Critically, he also stated his intention to scrap restrictions on the scope of business operations of foreign securities joint ventures, paving the way for foreign firms to operate with local counterparts unencumbered by burdensome regulations.

Markets seem to have welcomed the news. Both American and Hong Kong stocks rose after President Xi and Yi Gang’s statements. Even President Trump, one of the most vocal critics of Chinese trade and commercial practices in the past, expressed gratitude thanking President Xi over twitter.

American Manufacturing’s Crisis of Success

But the changing attitudes are unlikely to spread to all sectors of American business. Without structural reforms to the American economy, labor advocates and other manufacturing interests will remain particularly receptive to Trump’s populist worldview. Beginning in the early 2000’s, the explosion of imports from Mexico and China likely took a serious toll on manufacturing employment. In the short period between 2000-07, manufacturing employment dropped by 3.4 million, or approximately 20 percent of the initial level. Susan Houseman of the Upjohn Institute for Employment Research points out that a drop this large and swift is historically unpreceded in the history of American manufacturing (see red line below).

Forced to grapple with this sudden decline, many prominent economists, including Paul Krugman, reassessed their earlier view that international trade had played a negligent role in U.S. manufacturing decline relative to domestic considerations. Krugman still contended these domestic factors, such as improved technology and organization, were more significant than competition with China and Mexico. But he also acknowledged that the impact international trade had after 2000 was clearly distinct from the period that preceded it because U.S. imports increasingly came from less-developed countries with much lower wages (i.e. China and Mexico, not South Korea, Taiwan, Hong Kong, and Singapore).

So how is competition with low-wage countries relevant to the current trade dispute with China? Far from the country it was when it entered the WTO in 2001, China has even surpassed the developmental achievements of the much smaller East Asian “tigers” in the 1980’s and 90’s. A testament of China’s achievements is the increasing share of value-added products in its total exports that were previously dominated by raw materials like steel and aluminum. Of the $46 billion of tariffs proposed on Chinese goods as of April 3, the majority come from more advanced manufacturing sectors, such as electronics and medical equipment.

With Trump, however, it is not necessarily the substance of the dispute that matters, but the psychology. Aside from the possible exception of immigration, the most consistent theme President Trump repeated on the campaign is that America was great when American workers in hard hats made stuff. And workers are no longer making stuff because China (and Mexico) are stealing jobs. President Trump intuitively understands the way scapegoating resonated with many of his voters. These tariff proposals are an indication that he plans to double down on the messaging that brought him success in the last presidential election.

The danger of translating Trump’s campaign rhetoric into policy is that his beliefs are based on an illusion. Today, the U.S.’s manufacturing output is as high as it has ever been (see figure below). The industry has not collapsed as portrayed in President Trump’s American carnage speech at inauguration. We are simply making a lot more stuff with fewer hard hats. It is therefore more appropriate to think of the crisis in American manufacturing as a crisis of success. Americans are victims of their own efficiency, and we have failed to equip dislocated workers with the skills they need to adjust.

The decline in American manufacturing employment is also a much longer trend than the absolute employment numbers suggest. These statistics seem to illustrate that manufacturing employment was mostly stable after WWII until some event punctuated the normal equilibrium around 2000, which caused employment to decline sharply. One event that happens to align with this timeline is China’s entrance to the WTO. Some experts, like the US Trade Representative Robert Lighthizer, may conclude that China’s entrance to the WTO eviscerated American manufacturing and that supporting its accession was a mistake.

As is often the case in economics research, the validity of this conclusion should be questioned because it depends on dubious data analysis. Most economists have reached a consensus that a better way to measure the decline of American manufacturing employment is not the absolute numbers, but the relative manufacturing employment ratio (see figure below).

When the decline in manufacturing is presented in this way, the period coinciding with China’s entrance to the WTO becomes much less distinct (see red line). In fact, the decline of American manufacturing employment ratios has been remarkably consistent over decades, suggesting that automation is much more important than the emergence of low-wage competition. As Paul Krugman stated when the stark absolute decline in employment was first observed, that does not imply that Chinese imports had no effect on U.S. manufacturing employment. The above graph demonstrates that the decline of manufacturing employment from 2000-07 is slightly steeper (red line) than the decline that immediately preceded it (blue line). Competition with Chinese imports may be responsible for the difference.

But it is clearly not the main factor behind the overall long-term decline of manufacturing employment as depicted by figure 3. Decades of studies show that job losses attributable to international trade are no higher than 25 percent and frequently as low as ten percent. In the context of this economics literature, any study (see link to aforementioned Houseman report) that significantly downplays the role of technology and organization should be recognized for what it is—an outlier.

Conclusion

Assigning blame for our manufacturing woes to the Chinese detracts from the fundamental problem, which is to ensure that benefits of globalization are managed in a socially sustainable fashion. I wrote in a blog post last month reacting to Xiang Songzuo’s commentary that the effectiveness of a particular country’s global leadership depends on how well it treats its citizens. Americans have an obligation to serve at the helm of global trade institutions. Frankly, the Trump administration’s lack of faith in the infrastructure we helped create after World War II is disturbing.

But that leadership will not be effective unless Americans address the neglect of our own citizens. The U.S. only spends 0.1 percent of its GDP on assisting displaced workers to transition to the growing service industry, making it an outlier in the developed world. Even China, a country that faces many other higher priority challenges, dealt with this issue productively when it lost five million manufacturing jobs between 2014-15. Unlike the U.S., China resisted the urge to blame foreigners.

For the U.S., the most relevant remarks do not come from Xi Jinping at Boao or Davos in 2017 but from another Chinese leader, Deng Xiaoping, after he initiated Reform and Open-Up. Deng’s insight was that the way to approach our current wave of populism is to first look inward to the sources of our domestic problems with the understanding their resolution will inspire other countries looking to subdue populist rage. Blaming the Chinese without examining the actual factors that contributed to the loss of manufacturing work will only intensify this rage.

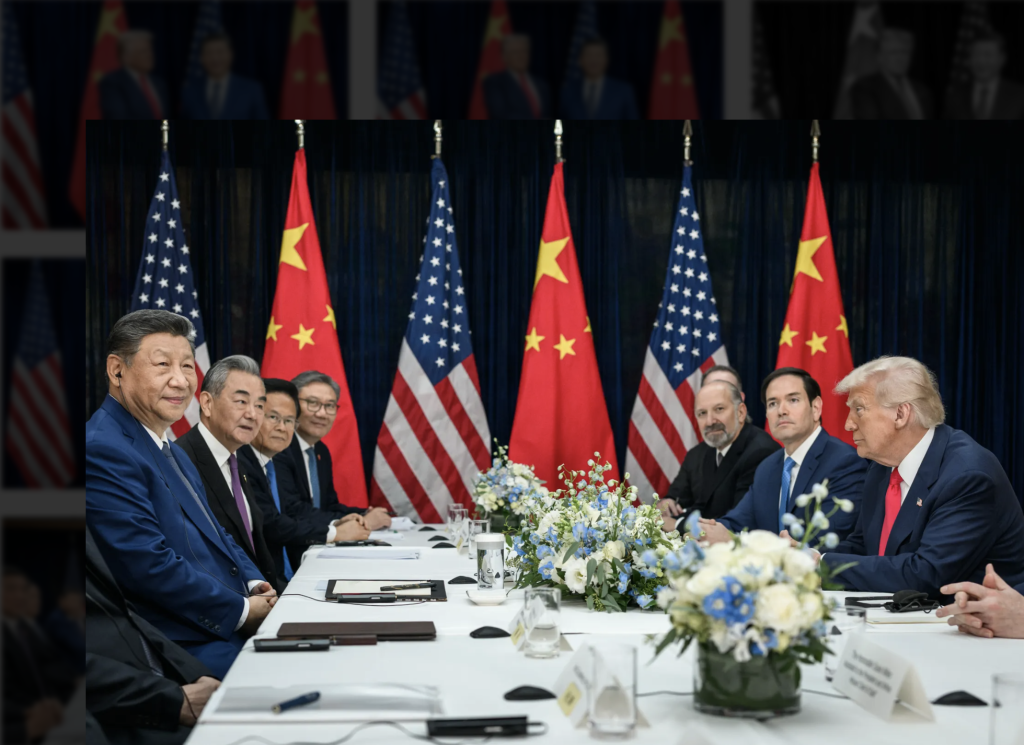

(Featured Image Credit: The New Indian Express)

Figure Credits: Figure 1 showing the absolute decline in American manufacturing employment comes from this report written by Susan Houseman. Figures 2 and 3 showing historical trend of manufacturing output and the decline in manufacturing to total employment ratio, respectively, come from this article in The International Economy written by William Overholt. Two graphs were modified slightly to highlight specific trends.

By VINCENT PALUMBO-SMITH

Vincent Palumbo-Smith is a Spring 2018 intern for The Carter Center’s China Program.